Hey, welcome back to my mission: Sharing what I’ve learned about how to defend ourselves against the health care system’s ongoing campaign to bleed all of us totally dry.

And to do it without letting you give up hope. You ready? Let’s freaking do this.

Today’s topic: Picking health insurance plans

We’re publishing this in November, which means open enrollment for most people — time to choose a plan for next year.

Topline advice: Please don’t just pick the plan with the lowest monthly charge. It could really, really cost you more.

Everything else: We’re starting this time with a framework and some vocabulary. But honestly, picking insurance is so complicated. It’s gonna take us at least a couple issues of this newsletter to give you all the information you need. So stay tuned.

To begin, economists who study health insurance say picking the best plan is almost impossible, but not all health insurance plans are created equally crappy. You absolutely can weed out the real losers.

To eliminate those — and to evaluate the ones that remain — you should run two scenarios for any plan:

What you’d probably pay out in a “normal” year

Whatever that looks like for you. Maybe you’re super-healthy and never go to the doctor; maybe you’ve got some ongoing stuff you do — prescriptions you take, regular appointments.What you’d be on the hook for if something really lousy happened

Say you got hit by a bus, or got hospitalized because of some stupid global pandemic.

Believe it or not, some plans cost more in either scenario. We’re gonna avoid those.

Any remaining choices will have some pros and cons. We’ll make sure you’ve got tools to evaluate them too.

And the whole process is annoying. But having extra-crappy insurance is worse, so…hang in there, and here’s a preview of what’s involved in making a less-crappy pick.

Six Steps:

Know Thyself

Basic Vocabulary

Bonus @#$% Vocabulary

Advanced @#$% Vocabulary

Math

Weighing your options

Know thyself: What does a “normal” version of next year look like (medically speaking)?

Let’s assume you’ll get a checkup (even though lots of us don’t), which all insurance is supposed to cover (even though medical offices find ways to tack extra fees on).

What else?

Are there prescriptions you take? Medical devices you need?

Any tests you’re supposed to do? (Like a mammogram, or a colonoscopy, or…)?

Anything coming up that you know about? Pregnancy, knee replacement, what-have-you?

How often do you visit the doctor?

Be honest: is there anything that you should do, but have been putting off? (Therapy…we’re looking at you. Also you, weird rash.)

Also consider: How important are the care providers you see? Are they people you love? Or would you be willing to change?

If the answer is: “No doctor visits, no drugs” then congratulations, O young-and-immortal one! Some of the upcoming math will be easier for you.

2. Basic Vocabulary: The five terms you 💯 need to know:

You may already know all these very-annoying words, but in case you could use a quick review.

Premium: This is the amount you pay the insurance folks every month.

Deductible: This is an amount you’d pay for medical care before your insurance kicks in at all. When we shopped for insurance at my house, one of the plans I looked at had a deductible of $17,000.

Copays: This is the amount you pay — a specific dollar amount — when you go to the doctor’s office, or a physical therapy appointment, or to pick up a prescription.

Co-insurance: This is when something really expensive happens, like a hospital visit, and the insurance company is like “We’ll pay 90 percent of this.” Or 80. Or 70. That means you pay 10. (Or 20. Or 30.) Even 10 percent of a LOT is…a lot.

Out of pocket max: Sweet relief, we hope. This is just what it sounds like: The most you’d ever have to pay in a year. (Except, see: Bonus @#$% vocabulary, coming right up…)

3. Bonus @#$% vocabulary: The most obscene words in the English language

“Out-of-network.” Which, in insurance-speak, means: “You’re on your own here.”

If a doc — or hospital, or whoever — is out-of-network, insurance may pay them something, but the bill could be a whole lot higher, and you could be on the hook.

But the extra-evil part is how “out-of-network” interacts with some of those Basic Vocabulary words we just dealt with.

Like deductible: When you’re “out-of-network,” you usually have a separate deductible, just for out-of-network stuff. It may be higher than your regular (“in-network”) deductible. And anything you’ve paid toward that regular deductible doesn’t count. You start over.

And then there’s the out-of-pocket max. In lots of cases, there’s no maximum for “out of network.”

Anything goes.

It means when we’re evaluating the “What if I got hit by a bus” scenario, we’ve gotta ask, “Could I end up in a hospital where they don’t take my insurance?”

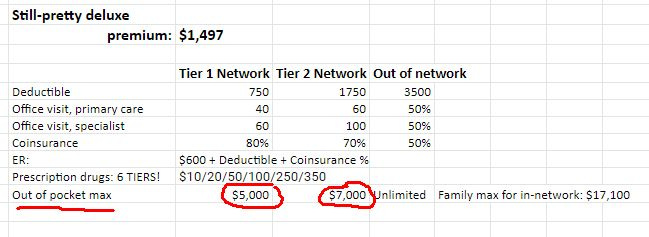

4. Advanced @#$% vocabulary: Tiers

This is where health insurance companies make the math extra hard and annoying.

A lot of insurance plans split “in-network” into tiers. Basically, “Tier 1” means “We pay the most, you pay the least.”

“Tier 2” means: “Better than out-of-network, but get ready for some financial pain.”

Before you choose a plan, you should check. Is there a hospital near you (one that doesn’t seem like it belongs on Shutter Island) that’s in the best tier?

Oh, and: One really common place for tiers? Prescription drugs.

When we shopped for insurance at my house last year, we saw a plan where, for the most-expensive drugs — like some cancer drugs these days — you were supposed to pay 40 percent.

40 percent of a lot is still a lot. Here is part of a list of the most expensive drugs in the U.S.

5. Math. (As if you weren’t annoyed enough already.)

You'll need a notebook or a spreadsheet. And maybe a nice, refreshing beverage.

How you set it up is up to you. But this is where you run those two scenarios for any plan you’re considering:

How much do I shell out in a “normal” year?

Start with the premium. If there are drugs you take, or docs you check in with, or some kind of ongoing treatment — well, you’ve got some math to do.

And definitely check about networks and tiers. Or, again, consider if you’re willing to switch docs.How much would I shell out if I got hit by a freaking bus?

Always fun to contemplate (🙃). In our house, we mainly looked at the out-of-pocket max and we looked at the networks and tiers, to make sure that we could get treated at places nearby.Bonus: When you do this, don’t forget to add the premium to any out-of-pocket max. Because you’ll be paying the damn premium anyway.

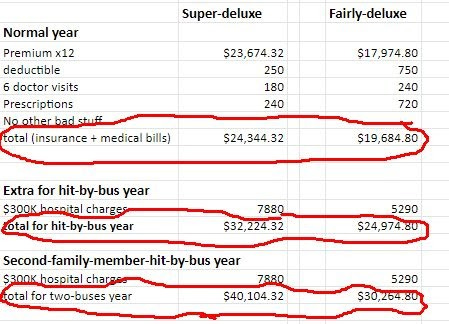

Here’s a version of how this worked for me and my family.

We looked at two plans, one Super-Deluxe and one just Fairly-Deluxe, which I’ve adapted a little here.

The Super-Deluxe was simpler to understand:

The Fairly-Deluxe plan had a lower monthly premium. But (bad news) it also had tiers, and higher copays and stuff… but (good news) it also had a lower out-of-pocket max!

Hm. So how did the math work out?

Like this!

Whoa! The Super-Deluxe plan was gonna cost us more, no matter what. Normal year, hit-by-a-bus year. Even if two of our three family members got hit by the same bus, we’d end up spending less with the Fairly-Deluxe plan.

So time to give the Super-Deluxe plan the boot.

6. Weighing your options

Now that you’ve eliminated the true losers, the same math can help you choose among whatever’s left (which may not look great either).

If you’re super lucky, you’ve got a winner: A plan that’s cheap in a normal year and gives you good protection in a hit-by-a-bus year. Pick that one.

Otherwise, you’re probably gonna have to balance: Are you willing and able to pay more in a normal year, if it means extra protection in a hit-by-a-bus year?

Meanwhile, we’ve still got more ground to cover to make sure you’ve got the info you need to do the math.

That’s part 1 of our picking-health-insurance crash course on First Aid Kit:

Part 2: WTF even *is* this insurance I’m picking? (A guide to all the weird terms and alphabet soup.)

Part 3: Why you shouldn’t use Google to look for health insurance. (Because scammers are using it to get at your wallet.)

Meanwhile, for extra credit, we’ve got more resources for you below.

Thanks for joining us for the beginning of First Aid Kit! Catch you here next week.

Till then, take care of yourself.

Dan

P.S. If you like what we’re doing, I hope you’ll donate to support this project.

Right now, your donations count for double: During November and December, a project called NewsMatch will match every single one. So please, step right up and donate!

Bonus Resources:

The best for-beginners guidebook on health insurance, in my opinion, is For Your Health: Making Sense of American Health Insurance. Starts with “What is it, and why do I need it?” and goes on from there.

It’s a labor of love: Author (and Arm and a Leg listener) Anna Jo Beck gave herself an education on the topic after her husband was diagnosed with cancer (he’s fine now) — and captured what she learned in this charming and smart self-published booklet.

You can read it online for free, but for $6 you can have your own copy. (I do not get a commission on this. I just love it.)

A lot of inspiration for the instructions above — including the hit-by-a-bus image — comes from this story by Zachary Tracer from Business Insider: My company offers free health insurance — here’s why I decided to spend $1,000 more on a better plan. He links to lots of other resources there.

Another first-person expert take, from ace reporter Sarah Kliff: I’m a health-care reporter. Here’s how I shop for health insurance.

An early Arm And a Leg episode unpacks the research on how many people get confused and frustrated when it’s time to pick health insurance. Including smart economists.

To hear how it went when we had to pick health insurance at my house, here’s another Arm and a Leg episode: Fight! My family tries to pick health insurance for next year.

Love your writing Dan. You make ANYTHING entertaining to read. Oh and financially helpful too.

Health insurance is a giant headache! Thanks for the helpful info. But I’m wondering how to figure which hospitals are in Tier 1 or Tier 2 and what does that all mean…