Know your (new) rights under the No Surprises Act…

We’ll have to be @#$% vigilant about enforcing them. Here’s the plan.

Hey there—

I’m coming to you with some good tidings: we’ve actually got some new rights, thanks to a federal law called the No Surprises Act, which took effect January 1.

You may have heard about this law — among nerds like me, it’s a huge deal.

It can protect us from some of the most infuriating, expensive abuses (which were 100 percent legal in most places until now).

But there are loopholes. It’s gonna take work to enforce our rights. I’m here with a plan. You ready?

First: What is this?

The No Surprises Act addresses a widespread scam called “surprise bills.”

It goes like this: Say you go to a hospital — to the ER, say or to have surgery — and you pick a hospital that's in-network and takes your insurance.

Except then, one or more of the docs who ends up seeing you there is OUT of network, and doesn't take your insurance.

SURPRISE! You get a great big bill from that doc — totally separate from your hospital bill — and your insurance doesn't cover much of it. You’re on the hook for the rest.

This is super-common with ER docs, anesthesiologists, and radiologists: specialties where you generally don't get to choose which doc you see. Sometimes these are docs you don't even meet.

This happens all the time. I've seen estimates that 10 million surprise bills go out every year, that one out of five folks who go to ERs get surprise bills. I think that could be lowballing things.

The No Surprises Act basically says: From now on, if you get one of these bills, you're not on the hook. Your insurance company has to work it out with whoever is trying to bill you.

TL;DR: If you go to an in-network hospital, you’re now protected from an out-of-network bill for your care.

This is huge. It took Congress years to work up the guts to pass a law like this.

And now that it’s law, there’s a lot to know. A lot of warning labels.

To make sure I understood them all, I talked with Patricia Kelmar, healthcare campaigns director for a non-profit group called Public Interest Research Group; she lobbied to get the law passed and recently wrote up her own tip sheet for enforcing our rights.

Here’s a quick rundown of those warnings.

1. The No Surprises Act pretty much only applies to hospitals.

Anywhere else you go, you’re out of luck.

If you go to an urgent care clinic, or a doctor’s office, you don’t have any of these protections. No waiver to sign. No warning, you can get a bill for anything, from anybody. Lab services, radiology, you name it.

(OK, a few urgent-care places are licensed to practice emergency medicine, and they’re covered, but honestly, how are you supposed to know that? Who are you supposed to ask? “I guarantee you, the person at the front desk doesn't know how it's licensed,” Patricia said.)

This could even happen at your primary-care doctor’s office. Like, say you go for a checkup, and your doc says: I’d like to run some lab work. There’s someone right down the hall.

Patricia reminded us: That someone might be out of network for you, could send you a great big bill that your insurance doesn’t cover. Even though they’re sharing office space with your in-network doctor.

And even under the No Surprises Act, they don’t have to warn you or anything.

So, before you let anyone do anything, find out if your insurance covers them. We’ve got a big tip below about the right – and wrong – ways to ask this question.

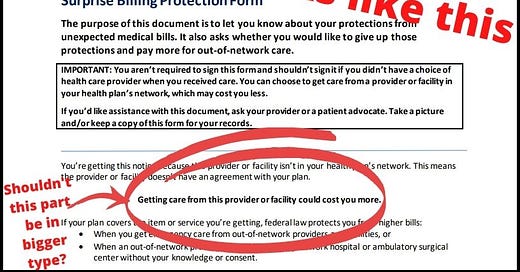

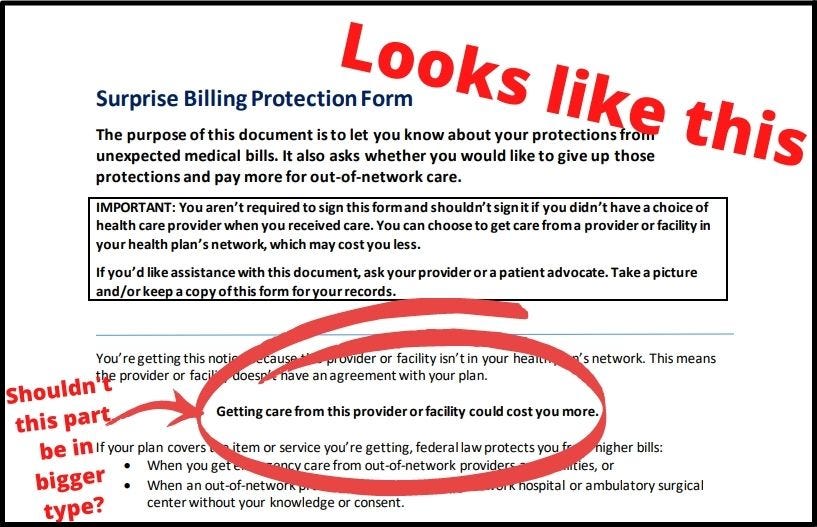

2. Beware the “Surprise Billing Protection Form”

Because the name is deceiving. “The form title should be something like the I'm Giving Away All of My Surprise Billing Protections When I Sign This Form, because that's really what it is,” Patricia said.

If you sign it, you’re actually consenting to be treated by out-of-network providers and to pay their rates. Which could be sky-high.

If someone tries to get you to sign a form like this, here are some things to know:

It’s supposed to include a “good-faith estimate” of what you’ll be charged. You don’t see that? They’re violating your rights.

It’s supposed to include the names of in-network providers you could see instead. They don’t have anybody in-network you can see? Then they don’t have any business asking you to sign this form.

Some places — like the emergency room — aren’t even allowed to ask you to sign this form. Neither are anesthesiologists, radiologists, assistant surgeons, hospitalists, and some other providers. So if you get asked? That’s illegal.

3. Wait, what do I do if I’m being screwed with?

Like, if you’re being asked to sign this form when you shouldn’t? Or it doesn’t include things it’s supposed to?

Do everything you can.

Officially, Patricia’s advice is “Don’t sign.”

But: Say you’re at the ER, and somebody wants you to sign away your protections? That’s illegal. But you’re in an emergency — otherwise, you wouldn’t be there.

I say: Fight back as you’re able. It could look several different ways:

Write on the form: “Signing under duress” and note ways that your rights are being violated (“This form does not include the required good faith estimate” or “This form does not include the required listing of in-network providers” or “Emergency Medicine facilities are not allowed to present this form.”)

Take a picture of the form with your notes on it.

Consider shooting a video of yourself, holding the form, describing how the request that you sign violates your rights.

REPORT the violation.

This brings me to a piece of good news: The Feds actually have a website and a hotline for reporting these violations.

4. 1-800-985-3059

Put that number in your phone right now. It’s the federal hotline for reporting violations of the No Surprises Act.

Also, bookmark the federal website for reporting violations.

The federal hotline and website are super-important, because the law’s enforcement mechanisms are SUPER-confusing. A bunch of different federal and state agencies can be involved, and figuring out which ones aren’t isn’t something mere mortals should have to deal with.

You call this number, and there’s supposed to be somebody on the other end who can guide you.

Patricia says the feds are contracting with a call center company to staff the hotline. If you’ve called a customer service line — the cable company, your health insurance — you know that can be a bit of a crapshoot, to put it mildly.

“But at least there’s somebody to call,” Patricia says. “Who could we call before? We didn’t even know who to call.”

Let’s call this a win for now. Save the number in your phone.

5. Don’t just ask “Do you take my insurance?”

You need to get more specific. Your insurance company — Blue Cross, Cigna, whoever — has a bunch of different plans, each with its own network.

So, Patricia says: She says the question you want to ask is: “Are you in my insurance plan’s network?”

Otherwise, Patricia says many providers will answer the less-specific do-you-take-my-insurance question with “Yes, we’ll take your insurance (and we’ll also send you an out of network bill).” Avoid that situation altogether by asking the right way.

And while you’re asking, get out your insurance card and read them the plan name, or the group number.

(Pro tip: Take a picture of that insurance card and save it in the “favorites” folder on your phone.)

6. Oh, also: Ambulances

They’re not covered by this. It’s a giant omission. Those bills can be $1,000 or more.

The reporter on this story got socked with $1,800 in charges, after insurance, for her own ambulance ride. (She got it knocked down to $283 by skillfully wrangling with her insurance. Scroll to the end of her story for details.)

However, air ambulances — helicopters — ARE covered. Which doesn’t come up as often, but still: Those folks sent bills in the tens of thousands of dollars all the time, and people had no recourse until now. So, this is an upgrade.

7. Finally: Watch the mail. Set aside time to sort through it.

This is an all-purpose First Aid Kit tip, and a big one in this context: You’ve got to stay on top of the mail because you need to make sure nobody’s trying to bill you for more than your insurance thinks you’re on the hook for.

And if you go to a hospital, you’re going to get a ton of paperwork.

That’ll include a bunch of bills and a bunch of statements from your insurance company called an Explanation of Benefits, or EOB for short.

Anything on a bill is supposed to also show up on those EOBs — which are supposed to “explain” what your insurance is paying and what you’re on the hook for.

Learning to read these is a whole skill (we’ll cover it later), but your goal is to verify nobody’s charging you more than your insurance thinks you’re responsible for.

Something doesn’t look right? Pour yourself a cup of coffee — or maybe an adult beverage — and make some calls. Call the insurance company. Call the provider. Call that federal hotline.

Hey, did I make you tired? Go do something nice for yourself. Seriously.

This fighting-for-our-rights thing can be SUPER-exhausting. Pace yourself. Do something you enjoy. If you’ve got a pet, go enjoy their company. You have earned it!

And we need to pace ourselves. We’ve got a lot of rights to fight for. It’s going to be kind of a theme around here.

During our break, I talked with a reporter for Money magazine about An Arm and a Leg, and when he asked for some quick advice for their readers, the answer helped set up how I’m approaching First Aid Kit these days.

Because, as I told him: While there’s no one-size-fits-all advice — the health-care-industrial-complex has too many different, sneaky, awful ways to come after us — there are a couple of big themes to what I’ve learned about defending ourselves.

And the first one is: We have rights when we’re dealing with health insurance companies, or with people sending us medical bills. Regulations, consumer-protection laws, contractual rights, all kinds of things.

And no one really tells us what they are, or what they can do for us, or how to enforce them. So we’ll be getting into detail on a lot of these rights over the next few months.

And remember today’s lesson: If you go to an in-network hospital, you’re now protected from an out-of-network bill for your care, and there are ways to enforce those rights.

Now, go take it easy. Save this newsletter (and if you found it helpful, share it with someone who might need it).

And speaking of pacing yourself: I’ve gotta do the same: Putting out a kickass podcast and making this newsletter the best I can every week is maybe more than I should be trying to do all at once.

So, this newsletter is gonna be an every-other-week thing for now.

Back at it, with more rights to fight for — and other hacks to avoid any avoidable screwing — in two weeks.

Till then, take care of yourself,

Dan

Resources

A ton of detail from our pals at the Kaiser Family Foundation. (They also run Kaiser Health News, which co-produces An Arm and a Leg. They’re not affiliated with the health care giant Kaiser Permanente; they share an ancestor. Interesting story. )

We covered the history of surprise billing in a 2019 episode called Can they Freaking DO That?!? It’s now a little out of date because now hospitals can’t send freaking surprise bills. Lots of it is still relevant, though, and it’s highly entertaining, no lie.

Here’s that interview with Money magazine about An Arm and a Leg.

Wanna hear me talking about the No Surprises Act on Chicago’s WBEZ? (I was on a crummy cellphone connection, so if you’re not my mom, I’ll understand if you pass.)

Dan - OUTSTANDING job summarizing how the No Surprise Act protects us from surprise medical bills! Excellent work!

What is the case for Medicare coverage?