Extra: One BIG tip if you signed up for a 2023 Obamacare plan

Double-check to make sure “in-network” docs are really in-network. Like, call them. Today.

Hey there —

A quick, extra newsletter today, because if this is relevant to you, then you want to know today. And maybe take some action.

If you signed up for a 2023 Obamacare plan — or know somebody who has: Double-check to make sure “in-network” docs are really in-network. Like, call them. Today.

Because with at least one big insurer, the one that enrolls the most people, your doctor — or almost any doctor you might need to see — may not be in network. Meaning: they may not actually take your insurance. And until January 15, you can still switch.

So I really recommend taking some time for due diligence now. It’s a major pain, but it could save you bigger pain down the line.

Susan’s nightmare tipped us off

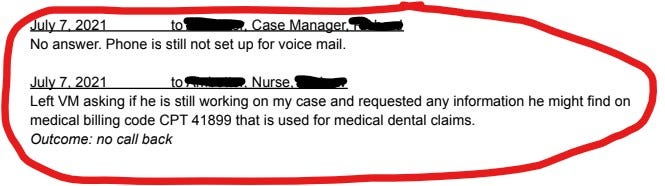

In a recent podcast episode, we told Susan Rice’s story. She lost a bunch of teeth when she got hit by a car and has spent 18 months trying to get her insurer to pay for reconstructive oral surgery.

Health insurance typically doesn't cover your teeth (argh, a whole other problem), but there are exceptions. Susan’s policy explicitly stated that *injury,* like a car accident, was such an exception.

Susan has been exceptionally diligent and organized in chasing her insurer, Ambetter. She shared a 29-page communication log with us, and it makes for some enraging reading.

At first, we thought Susan’s story was just a "normal" nightmare, but in the late going we discovered that her particular insurer is the target of a recently-filed class-action lawsuit.

The allegations in the lawsuit line up with her story in interesting ways.

The lawsuit alleges that provider networks for Ambetter plans — sold by parent company Centene in more than half the states — are “simply false.”

Meaning: The docs who Ambetter says accept its insurance plans… may well not take it.

This false-network allegation matches up with Susan Rice’s story: She needed an oral surgeon, but says she found none that actually accepted her Ambetter plan. Zero — in Atlanta, a big city.

The lawsuit also alleges: “Ambetter plans routinely refuse to pay for medical services and medications that the plan purportedly covers.”

As evidence, it cites seven prior lawsuits by providers against Ambetter’s parent company, Centene, and other subsidiaries.

Ghost networks

Ambetter may not be alone in having problems with “network accuracy.” It’s hard work for insurers to keep provider lists accurate, and some companies struggle to keep their lists updated.

We called the leading researcher on network accuracy, Simon Haeder, a professor at Texas A&M University’s School of Public Health.

The lawsuit’s specifics — patients calling lots of docs and sometimes failing to find even one that takes their Ambetter insurance — didn’t surprise Simon.

Researchers see these situations — sometimes called ghost networks — a lot. Simon says ghost networks aren’t a pervasive problem in the majority of plans,1 but in a substantial minority, they are.

Simon doesn’t have data showing Ambetter plans are over-represented in that minority, but he says it wouldn’t surprise him if they were.

Partly that’s because the parent company, Centene, specializes in serving low-income folks—with low-premium Obamacare plans, and managed-care plans for state Medicaid programs.

So for the company to make profits, they need to to keep costs low. And it’s costly to maintain big, accurate networks.

Centene’s rep could be better

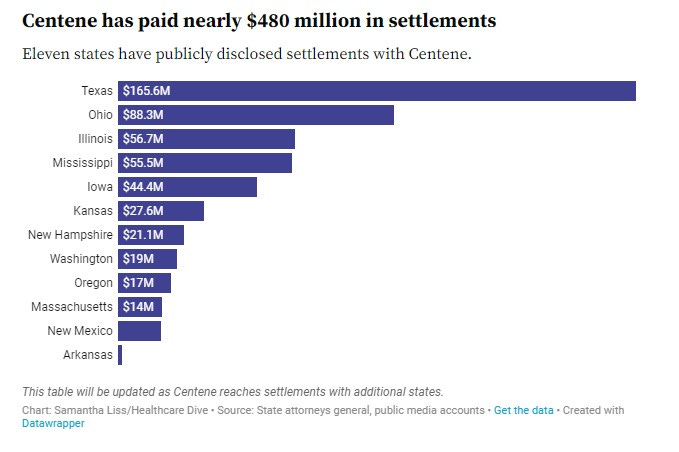

But Simon’s also not surprised for another reason: The company has made news because more than a dozen states have accused it of overbilling for pharmacy-benefit services in its Medicaid work.

One recent story lists almost a half-billion in settlements Centene has agreed to pay, and less than a week after that story came out, another settlement got announced.

Centene admits no wrongdoing in any of these state settlements. However, the company set aside a total of $1.25B last year to pay for these and similar settlements.

For all these reasons, Simon Haeder suggests: Centene seems like a company especially likely to have “network accuracy” problems.

Intentional or not, when it’s hard for folks to access care — in other words, to find an in-network doc — “that’s probably a net benefit for the company,” he says, “in terms of profits.” Ouch.

Why is this important right now?

If you bought 2023 Obamacare coverage, you’ve got until Jan. 15 to switch plans — if, for instance, you find out a provider you thought would be covered… actually isn’t.

So: Whatever doctors and providers your plan SAID you’d have access to? Call their offices and make extra sure. (Maybe especially if you’ve signed up with Ambetter.)

The feds offer some info to help you find the list of providers for your plan.

And if you are thinking about switching plans… last month’s First Aid Kit has our latest info, including links to an earlier series on picking insurance. (Sorry it’s so long. Picking insurance *sucks.*)

One big takeaway: The plan with the lowest premium may not be the best deal. And with subsidies that lots of folks qualify for, a better plan may not be that much more expensive.

Remember: You’ve got until January 15 to make a switch. It’s not a lot of time.

If you think somebody you know could benefit from this info, please forward this newsletter to them ASAP.

And: Let us know what you find out! So many of our stories come from listeners and readers, including this one.

Thanks so much for reading! This has been a special installment of First Aid Kit. We’ll be back soon with a regular installment, continuing our series about what to do if you get a messed-up medical bill.

Till then, take care of yourself.

Dan

Maybe excepting for mental health and addiction services. A huge set of nightmares.

Thank you for this information.

It's enraging, and I'm glad you are helping get the word out about this nonsense.